Generative AI and

Firm Values

Andrea L. Eisfeldt, Gregor Schubert, Bledi Taska, and Miao Ben Zhang

UCLA Anderson · UCLA Anderson · SkyHive · USC Marshall

- 1Generative AI occupation exposure scores

- 2Generative AI firm exposure scores

About This Project

The release of ChatGPT in November 2022 marked a watershed moment for generative AI adoption. This research examines how financial markets responded to this technological shift, focusing on firms' differential exposure based on their workforce composition.

We construct novel measures of generative AI exposure at both the occupation and firm levels, leveraging detailed task-level data to assess which jobs and companies face the greatest potential for AI-driven transformation. Our findings reveal significant market reactions: firms with higher AI exposure experienced positive abnormal returns following ChatGPT's release, suggesting investors anticipate productivity gains from AI adoption.

The "Artificial Minus Human" Portfolio

We construct a zero net investment portfolio that goes long on firms with the highest generative AI exposure ("Artificial") and short on firms with the lowest exposure ("Human").

Data Downloads

Occupation-Level Generative AI Exposure

Measures the proportion of tasks in each occupation that can be enhanced using Generative AI tools, assessed in March 2023 based on GPT-4 capabilities.

Variable Structure (4 columns):

- •SOC 2010 occupational codes

- •

genaiexp_estz_total- Total occupational GenAI exposure - •

genaiexp_estz_core- Exposure from core tasks only - •

genaiexp_estz_supplemental- Exposure from supplemental tasks

Firm-Level Generative AI Exposure

Measures expected weighted task share per firm that could benefit from Generative AI, based on March 2023 assessments and LinkedIn occupational employment structures.

Variable Structure (4 columns):

- •Firm GVKEY codes

- •

firmgenaiexp_estz_total- Total firm GenAI exposure - •

firmgenaiexp_estz_core- Core task contribution - •

firmgenaiexp_estz_supplemental- Supplemental task contribution

Key Findings

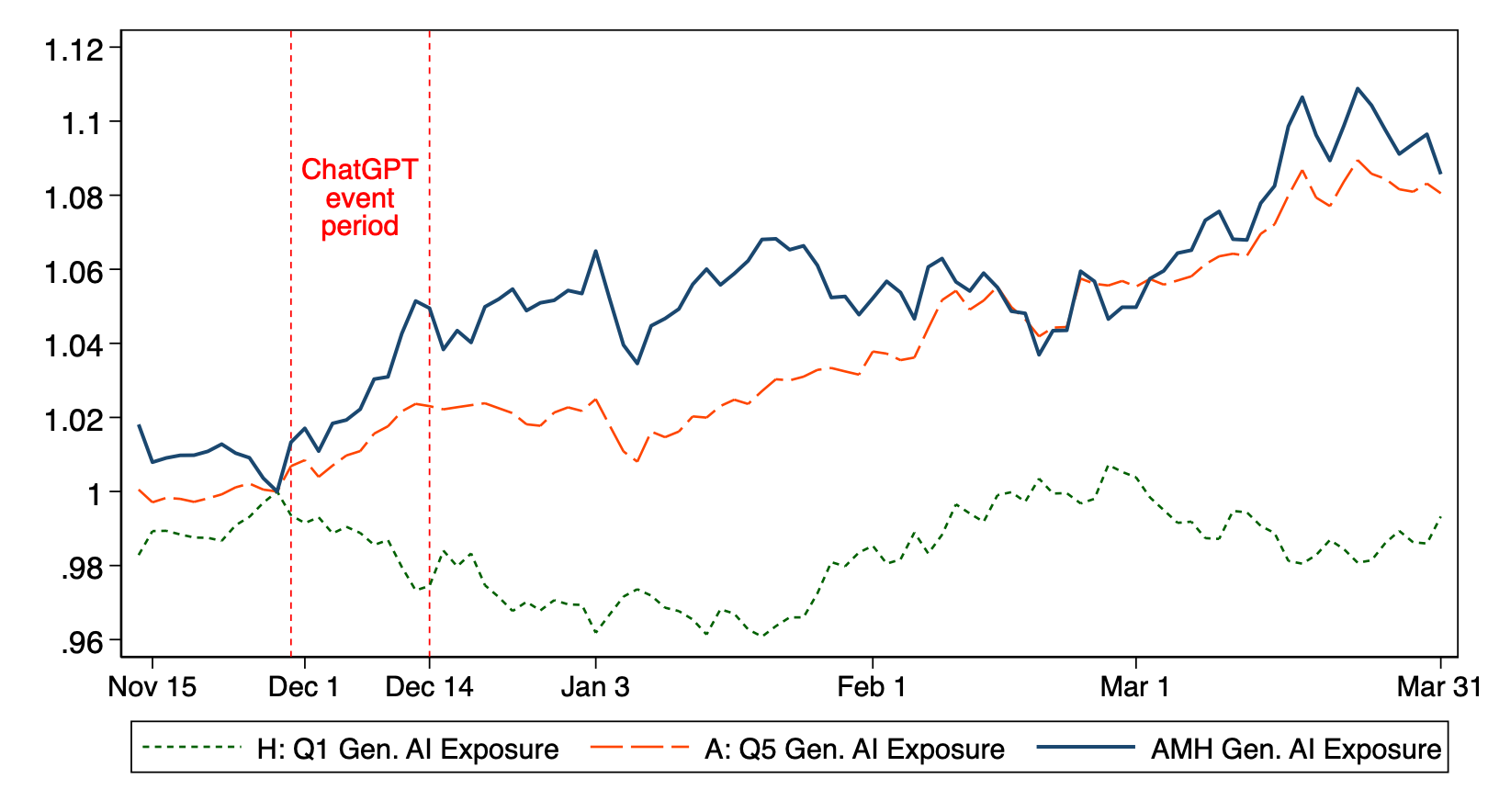

Stock Market Reaction to ChatGPT Release

Figure 1: Cumulative Abnormal Returns by Generative AI Exposure. The graph shows cumulative abnormal returns for portfolios sorted by firms' labor-based generative AI exposure. High-exposure firms ("Artificial") outperformed low-exposure firms ("Human") following ChatGPT's release on November 30, 2022, with the spread reaching over 2% during the event period.

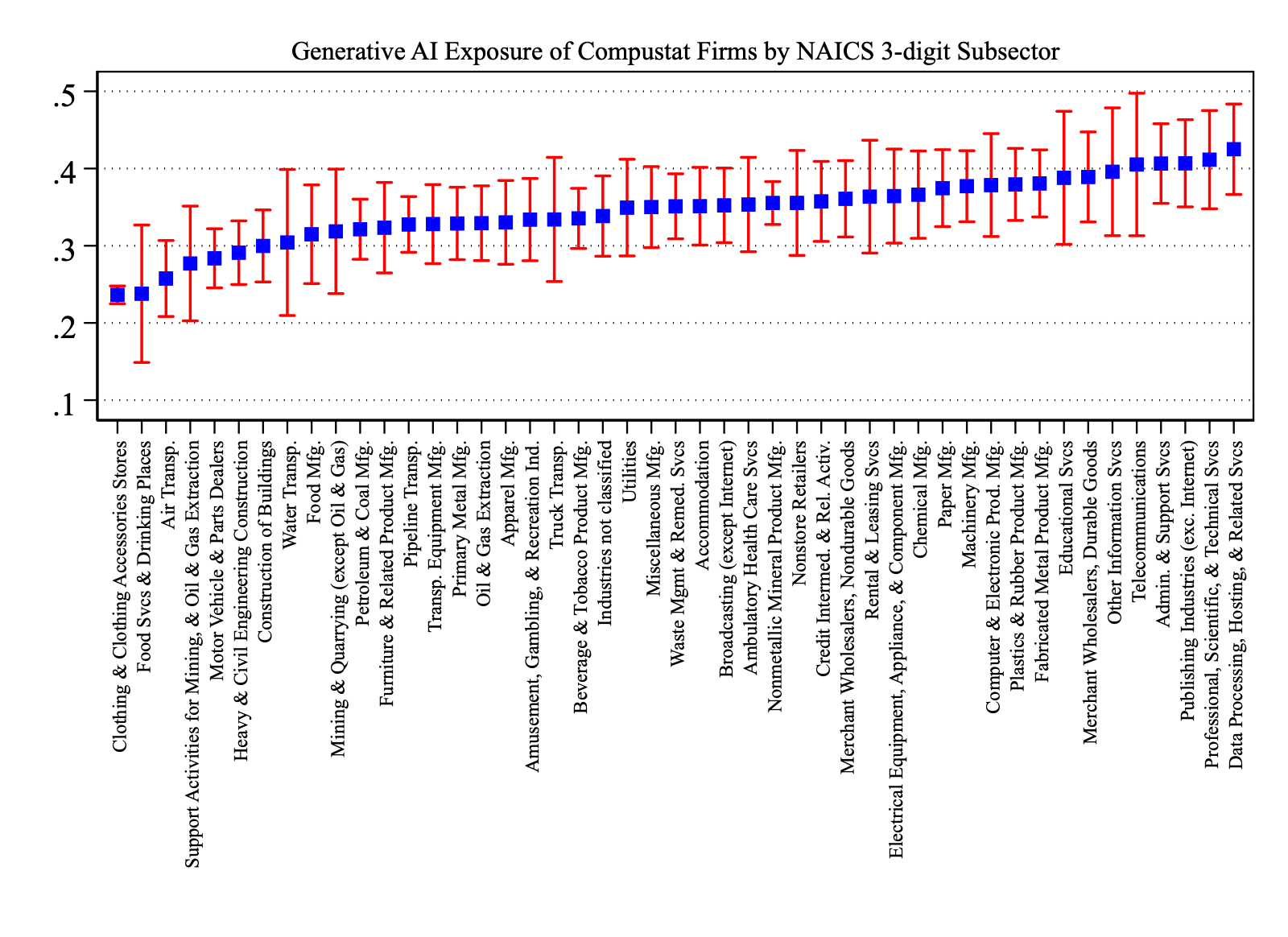

Generative AI Exposure Across Industries

Figure 2: Generative AI Exposure Within and Across Industries. This figure displays the average and standard deviation of firms' generative AI exposure within each NAICS 3-digit industry sector. Professional services, information, and finance sectors show the highest average exposure, while significant within-industry variation exists across most sectors.

Citation

Suggested Citation

Eisfeldt, Andrea L., Gregor Schubert, Bledi Taska, and Miao Ben Zhang. 2026. "Generative AI and Firm Values." Journal of Finance, forthcoming.

BibTeX Entry

@article{eisfeldt2026generative,

title={Generative AI and Firm Values},

author={Eisfeldt, Andrea L and Schubert, Gregor and Taska, Bledi and Zhang, Miao Ben},

journal={Journal of Finance},

year={2026},

note={Forthcoming}

}